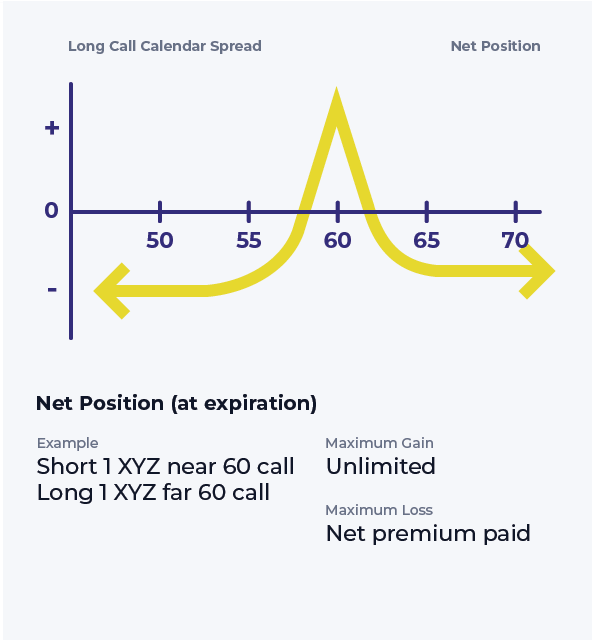

Long Call Calendar Spread

Long Call Calendar Spread - Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. This is a wager on a moderate price increase or rising volatility in. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position.

Long Calendar Spreads Unofficed

This is a wager on a moderate price increase or rising volatility in. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A trader.

Calendar Call Spread Options Edge

This is a wager on a moderate price increase or rising volatility in. A long calendar spread is a good strategy to use when you expect the. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Calendar spreads are a great way to combine.

Long Calendar Spreads for Beginner Options Traders projectfinance

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. A long calendar spread is a good strategy to use when you expect the. This is a wager on a moderate price increase or rising volatility in. A trader may use a long call.

Long Call Calendar Spread Explained (Options Trading Strategies For Beginners) YouTube

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position..

Investors Education Long Call Calendar Spread Webull

A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar spread is a good strategy to use when you expect the. This.

Long Call Calendar Spread Options Strategy

A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Learn how to create and manage a long calendar spread with calls, a strategy that.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

This is a wager on a moderate price increase or rising volatility in. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call.

Calendar Call Spread Strategy

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A long calendar spread is a good strategy to.

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A long calendar spread is a good strategy to use when you expect the. This is a wager on a moderate price increase or rising volatility in. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position.

Calendar Spreads Are A Great Way To Combine The Advantages Of Spreads And Directional Options Trades In The Same Position.

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. This is a wager on a moderate price increase or rising volatility in.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)